27+ Online sales tax calculator

Gross Amount including tax 10888. United States Sales Tax calculator.

Form 8621 Calculator Pay As You Go Form 8621 Calculator

Online sales tax calculator to find out sales tax by zip code in every state.

. Free sales tax calculator to lookup the sales tax rate and calculate sales tax by address or zip code in the US. Initially you can provide the details like Before Tax Price Tax Rate or simply choose. Net Amount excluding tax 10000.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Ad Ecommerce sales tax can be tricky. Ad Standardize Taxability on Sales and Purchase Transactions.

Ad Ecommerce sales tax can be tricky. Find out the sales tax rate. Enter the sales tax percentage.

Sales tax is paid. A tax of 75 percent was added to the product to make it equal to 3008925. Amount Tax Inclusive.

Find out the net price of a product. New Jersey has a 6625 statewide sales tax rate. How to calculate sales tax with our online sales tax calculator.

Learn about compliance with a free guide from Avalara. In our example let us make it 4. So divide 75 by 100 to get 0075.

Integrates Directly w Industry-Leading ERPs. Learn about compliance with a free guide from Avalara. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Type of supply learn about what. The steps are as beneath. Use this free easy-to-use online Sales Tax calculator to estimate the amount of tax you will pay and keep you and your business organized.

Fill in price either with or without sales tax. Sales tax is a tax that is paid to a tax authority for the sale of goods and services. Tax 203 tax value.

The rate you will charge depends on different factors see. To easily divide by 100 just move the decimal point two spaces to the left. See the tax rate amount and beforeafter price of your product.

For instance in Palm Springs California the total. Tax 27 0075. Divide the tax rate by 100.

Sales Tax Calculator. The process to use the Sales Tax Calculator is quite simple and straightforward. Now find the tax value by multiplying tax rate by the before tax price.

Sales tax is calculated by multiplying the. Total CostPrice including ST. Tax Rate Includes Tax.

Add one to the percentage. There is base sales tax by state. The calculator will show you the total sales tax amount as well as the county city.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. 1 0075 1075. You can use our Georgia Sales Tax Calculator to look up sales tax rates in Georgia by address zip code.

Counties cities and districts impose their own local taxes. By clicking Accept All Cookies you agree to. Get the free Avalara guide for ecommerce sales tax compliance.

Sales taxes can also be referred to as retail excise or privilege taxes depending on the state. The following table provides the GST and HST provincial rates since July 1 2010. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return.

Get the free Avalara guide for ecommerce sales tax compliance.

Vat Calculator

Vat Calculator

Vat Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Form 8621 Calculator Pay As You Go Form 8621 Calculator

Sales Tax Effects Of Sales Tax Objectives Of Sales Tax

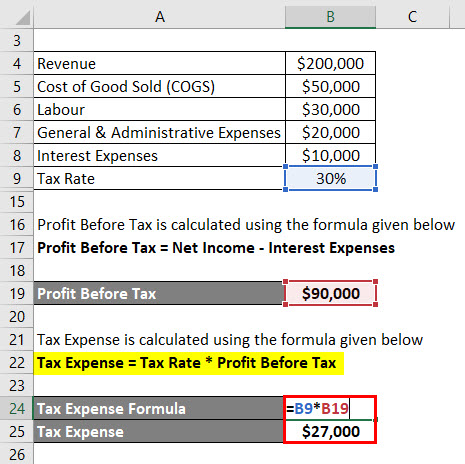

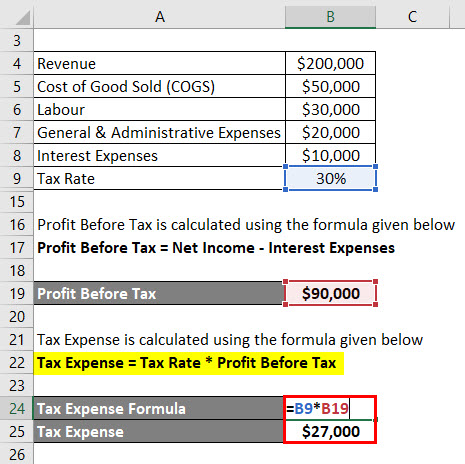

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Solved Please See Attachments For Details Course Hero

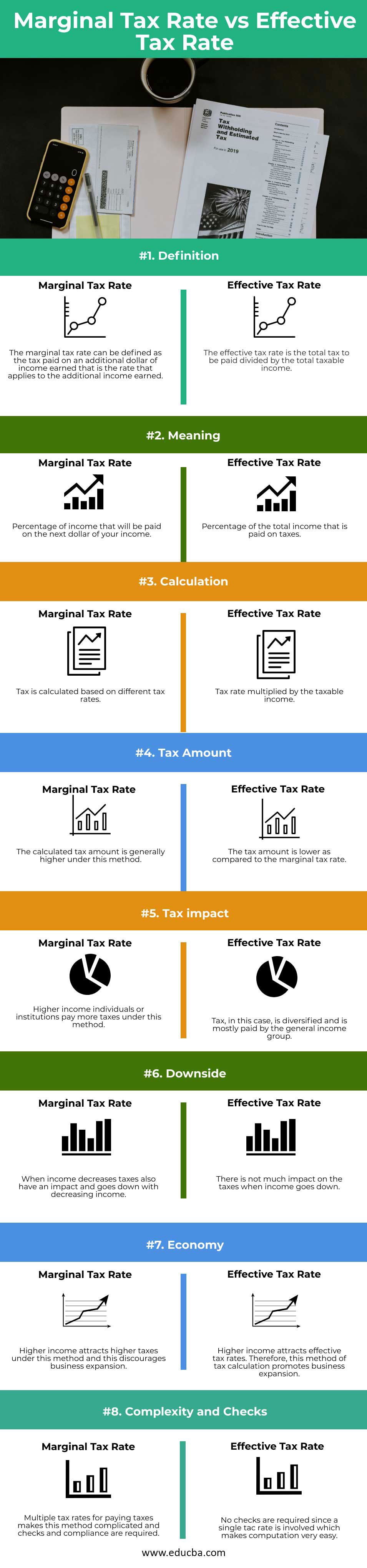

Marginal Vs Effective Tax Rate Top 8 Differences To Learn Infographics

Effective Tax Rate Formula Calculator Excel Template

Marginal Vs Effective Tax Rate Top 8 Differences To Learn Infographics

Vat Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Nopat Formula How To Calculate Nopat Excel Template

Solved Please See Attachments For Details Course Hero

Form 8621 Calculator Pay As You Go Form 8621 Calculator